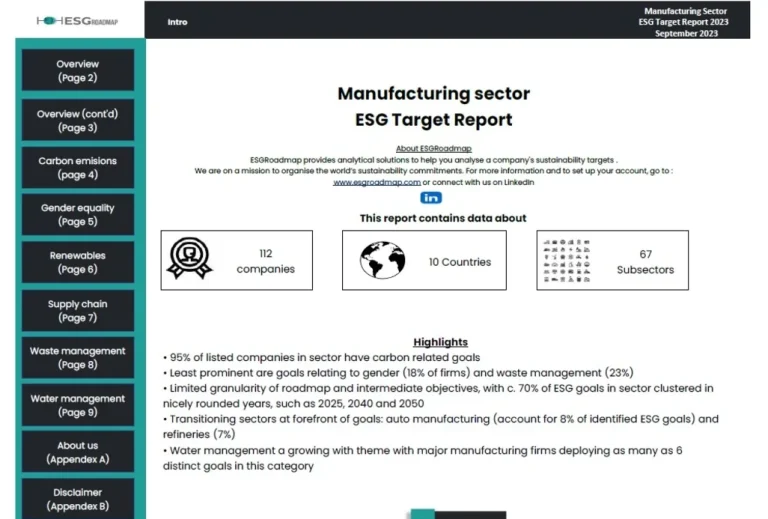

Manufacturing Sector 2023 ESG Target report

Click here to download our first ever manufacturing Sector 2023 ESG Target report, and find out exactly what sustainability goals manufacturing firms are committing to! Takeaways from the report: • 95% of listed companies in sector have carbon related goals • Least prominent are goals relating to gender (18% of firms) and waste management (23%)…