This is the “million dollar” question when assessing an organisation’s ESG targets. Is it really pushing itself or opting for a low-ball estimate of what it can achieve in the coming years?

For corporate executives, setting these types of goals requires striking a fine balance. On the one hand you want targets to be achievable, without putting undue strain on the company’s near term revenue and profitability goals. At the same time you want to show your stakeholders that are you are making a concerted sustainability effort, and that the goals show ambition in this regard.

Many corporate investments will have some environmental or social benefits. A company may want to upgrade its factory in order to produce more widgets. Such an upgrade will typically improve its energy efficiency (eg. new lighting systems) and can lead to employment opportunities. However, these co-benefits are a side effect of the aim to boost productivity.

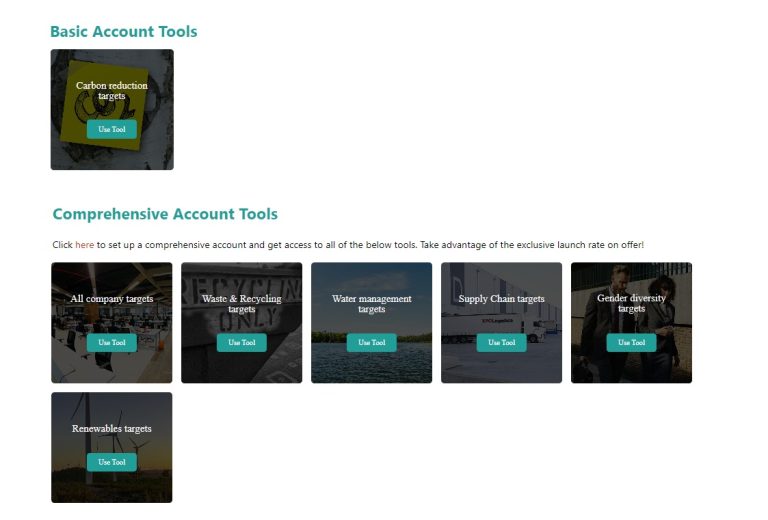

Separating such BAU goals from (sufficiently) ambitious targets is not straightforward. A helpful step is to compare them to a company’s peer group. This allows you to assess how much of a leader a company really is amongst comparable firms. Here ESGRoadmap can be of help. We allow you to search through specific categories of goals, and filter by sector and geography of companies.

You can also compare a goal to a company’s historic performance. While sustainability improvements are rarely linear, a firm’s track record does form an important baseline. The company reports that ESGRoadmap points to will typically give some backward looking information that you can use.

And for environmental goals there are industry pathways and scientific benchmarks to compare with – such as the International Energy Agency’s net zero trajectory for carbon goals. Companies that seek to align or outperform such pathways will typically state this in their announcement – so, again, reading the full report ESGRoadmap references for this information can be helpful.

Would you like more ESG analytical advice? Then subscribe to our newsletter (see bottom of the contact us page).