Press release: New ESG analytical startup promises “only raw data”

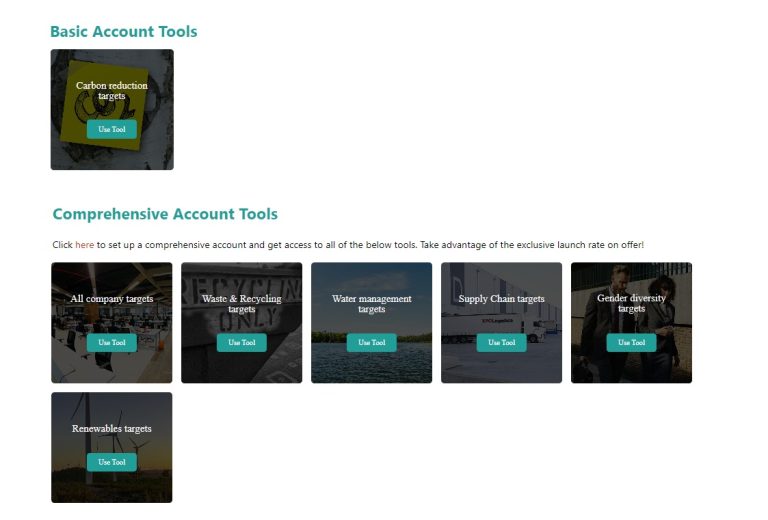

Amidst a plethora of “black box” sustainability ratings providers, new startup ESGRoadmap sets out to provide only reliable, primary source information. It has been launched today with 6 distinct tools covering over 500 of the world’s largest companies. The company’s mission is to “organise the world’s sustainability commitments”. Its solutions seek to help stakeholders get…