It can be tempting to hide behind “readily processed” ESG data. Yet this can be just as unhealthy as a diet of 100% readily processed food!

ESG ratings have an important role to fulfil, but should not be blindly relied upon. They have widely differing methodologies. These are often updated without a transparent and broad stakeholder consultation process. And they tend to be reliant on backward-looking information, focusing on the company’s historic reported sustainability metrics and controversies.

Back-ward looking information is of course insufficient. You also require knowledge on the company’s goals and aspirations – where they are hoping to take their sustainability profile. Many companies in higher emitting sectors are investing heavily in the energy transition, for instance. And a specific environmental claim from a few years ago can already be “old news”, noting the firm has set up robust sustainability policies and targets.

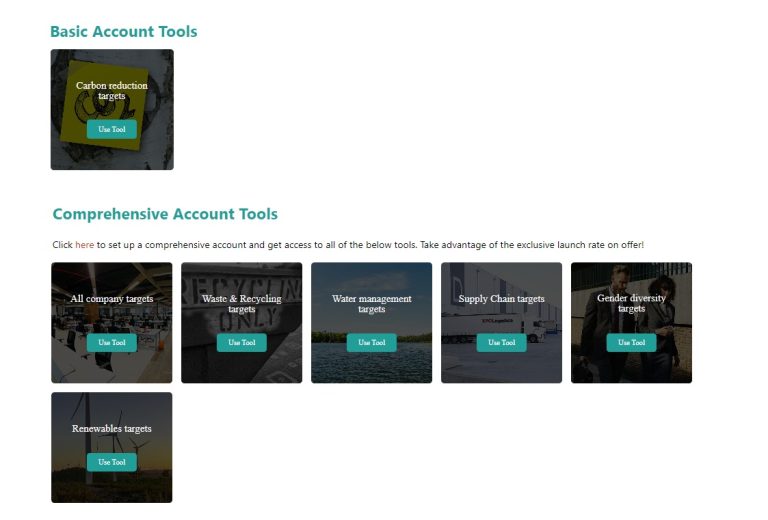

In this regard ESGRoadmap is a useful complementary tool to ESG ratings. When you find a company scoring quite poorly on a particular sustainability metric, you can utilise ESGRoadmap to assess whether it has set targets in this area. If it is a highly emitting firm, is it looking to address this through a carbon transition plan? For firms with an uneven gender balance in their management, do they have goals to change this?

This can help you contextualise data received from ESG data providers. And add a degree of forward looking perspective to your assessment.

Would you like more ESG analytical advice? Then subscribe to our newsletter (see bottom of the contact us page).