Major corporate events can have a meaningful impact on a firm’s sustainability profile. Acquiring another business that has poor environmental track record may be a setback for your own sustainability ambitions. Yet an M&A event may also be an ESG positive. Acquisitions can be made with the goal of accelerating a firm’s own decarbonisation trajectory – for instance by purchasing organisation with specific greentech knowledge or other sustainable assets. Typically this would then be noted in the associated announcement, investor presentation and press release.

Material acquisitions are typically followed by changes to sustainability targets, a “rebenchmarking” exercise. Many sustainability-linked financial instruments have such provisions, given firm’s leeway when their business profile significantly changes.

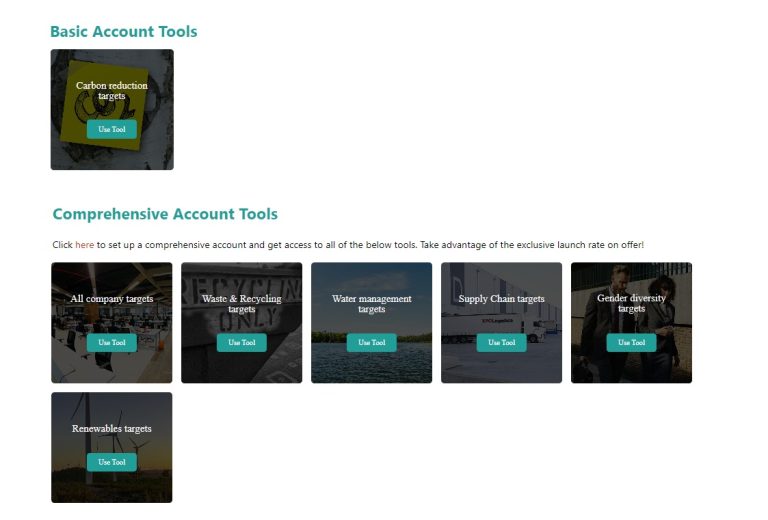

When assessing companies in highly acquisitive sectors, it is important to take this into account. With ESG Roadmap, you can quickly access the documents that describe a firm’s sustainability goals. It is worth consulting announcements made both before and after the acquisition took place (in some case, you may even find ones from during the take-over process): The ones before may describe the intended implementation strategy, which may include acquisition of specific “green” assets or know-how. And the ones from after the acquisition announcement may reflect on implications of this acquisition on the sustainability trajectory of the combined entity.

Would you like more ESG analytical advice? Then subscribe to our newsletter (see bottom of the contact us page).